Learn About the Six Ballot Questions for 2023

Monday, May 15, 2023 – Polls are open 7:00 AM – 8:00 PM

Hopkinton Middle School Brown Gym, 88 Hayden Rowe St

Hopkinton Annual Town Election Specimen Ballot – May 15, 2023 (PDF)

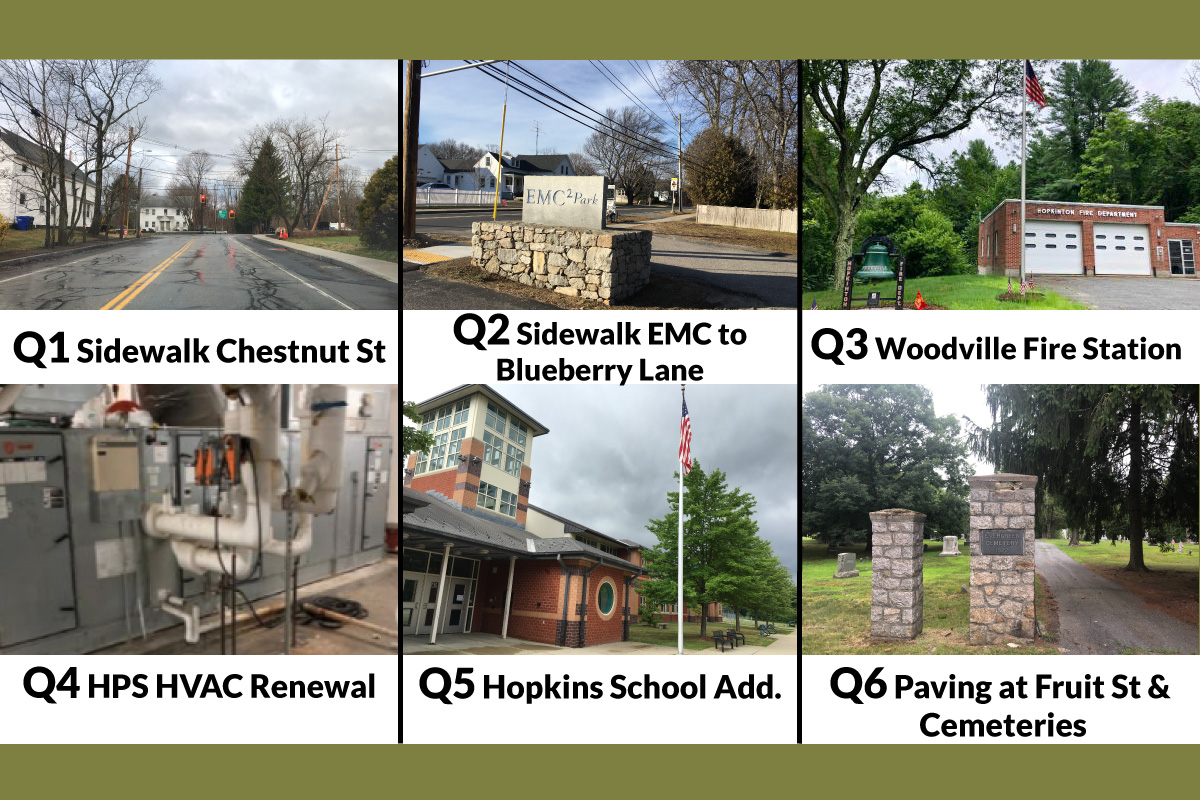

Ballot Questions:

QUESTION 1

Shall the Town of Hopkinton be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bond issued in order to pay for the design, engineering, permitting, and construction of a new sidewalk on Chestnut St. from Wild Road to Smith Road, including any and all costs, fees, and expenses related to the same?

At the 2023 Annual Town Meeting (Article 15), the Town voted to raise and appropriate $514,250 for this purpose, and to meet that appropriation by authorizing the Town to borrow the funds to cover that cost. This borrowing was made contingent upon the passage of a debt exclusion under Proposition 2 ½, authorizing a temporary increase in the Town’s tax levy limit to cover the cost of borrowing for this item.

A YES vote would mean that the borrowing is approved and the expenditure will proceed.

A NO vote would mean that the borrowing is disapproved and the expenditure cannot proceed without a future ballot vote within 90 days.

Cost: $514,250.

Tax Impact: 0.05% or $9/year on the average house valued at $753,300

QUESTION 2

Shall the Town of Hopkinton be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bond issued in order to pay for the design, engineering, permitting, and construction of a new sidewalk between EMC Park and Fitch Avenue, connecting to Blueberry Lane, including any and all costs, fees, and expenses related to the same?

At the 2023 Annual Town Meeting (Article 16), the Town voted to raise and appropriate $187,000 for this purpose, and to meet that appropriation by authorizing the Town to borrow the funds to cover that cost. This borrowing was made contingent upon the passage of a debt exclusion under Proposition 2 ½, authorizing a temporary increase in the Town’s tax levy limit to cover the cost of borrowing for this item.

A YES vote would mean that the borrowing is approved and the expenditure will proceed.

A NO vote would mean that the borrowing is disapproved and the expenditure cannot proceed without a future ballot vote within 90 days.

Cost: $187,000

Tax Impact: 0.02% or $3/year on the average house valued at $753,300

QUESTION 3

Shall the Town of Hopkinton be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bond issued in order to pay architectural and engineering design for Fire Station 2?

At the 2023 Annual Town Meeting (Article 17), the Town voted to raise and appropriate $70,000 for this purpose, and to meet that appropriation by authorizing the Town to borrow the funds to cover that cost. This borrowing was made contingent upon the passage of a debt exclusion under Proposition 2 ½, authorizing a temporary increase in the Town’s tax levy limit to cover the cost of borrowing for this item.

A YES vote would mean that the borrowing is approved and the expenditure will proceed.

A NO vote would mean that the borrowing is disapproved and the expenditure cannot proceed without a future ballot vote within 90 days.

Cost: $70,000

Tax Impact: 0.02% or $3/year on the average house valued at $753,300

QUESTION 4

Shall the Town of Hopkinton be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bond issued in order to pay for Hopkinton Public School HVAC renewal work?

At the 2023 Annual Town Meeting (Article 18), the Town voted to raise and appropriate $1,506,259 for this purpose, and to meet that appropriation by authorizing the Town to borrow the funds to cover that cost. This borrowing was made contingent upon the passage of a debt exclusion under Proposition 2 ½, authorizing a temporary increase in the Town’s tax levy limit to cover the cost of borrowing for this item.

A YES vote would mean that the borrowing is approved and the expenditure will proceed.

A NO vote would mean that the borrowing is disapproved and the expenditure cannot proceed without a future ballot vote within 90 days.

Cost: $1,506,259

Tax Impact: 0.14% or $31/year on the average house valued at $753,300

QUESTION 5

Shall the Town of Hopkinton be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bond issued in order to pay for the Hopkins School Addition (Design & Engineering) project?

At the 2023 Annual Town Meeting (Article 19), the Town voted to raise and appropriate $3,000,000 for this purpose, and to meet that appropriation by authorizing the Town to borrow $800,000 the funds to cover that cost, with the $2,200,000 remainder coming from School Department Stabilization Fund. This borrowing was made contingent upon the passage of a debt exclusion under Proposition 2 ½, authorizing a temporary increase in the Town’s tax levy limit to cover the cost of borrowing for this item.

A YES vote would mean that the borrowing is approved and the expenditure will proceed.

A NO vote would mean that the borrowing is disapproved and the expenditure cannot proceed without a future ballot vote within 90 days.

Cost: $800,000

Tax Impact: 0.21% or $9/year on the average house valued at $753,300

QUESTION 6

Shall the Town of Hopkinton be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bond issued in order to pay for reconstruction and paving of Pratt Way and the roadways within Evergreen and Mount Auburn Cemeteries?

At the 2023 Annual Town Meeting (Article 20), the Town voted to raise and appropriate $480,000 for this purpose, and to meet that appropriation by authorizing the Town to borrow the funds to cover that cost. This borrowing was made contingent upon the passage of a debt exclusion under Proposition 2 ½, authorizing a temporary increase in the Town’s tax levy limit to cover the cost of borrowing for this item.

A YES vote would mean that the borrowing is approved and the expenditure will proceed.

A NO vote would mean that the borrowing is disapproved and the expenditure cannot proceed without a future ballot vote within 90 days.

Cost: $480,000

Tax Impact: 0.04% or $8/year on the average house valued at $753,300